About Program

About Program

MA Vacancies

MA Vacancies

Experience Sharing

Experience Sharing

How to Apply

How to Apply

Selection Process

Selection Process

FAQ

FAQ

Event Highlights

Event Highlights

Apply Now

Apply Now

CTBC had the concept of cultivating management associate 4 decades ago, while the institutionalized MA program started since 2003, and has became a cradle of professional managers in Taiwan's financial industry. We have the most acclaimed MA program with an abundant of training resources, and the international stage that makes these talents shine.

2024 MA program has entered its 21th anniversary after the institutionalization. Welcome talents with SMART characteristics to work with us and join the CTBC family. Expanding the international scope and leading the digital trend, it is CTBC Holding's next great peak. Join CTBC, Make your life Amazing!

If you could turn back time, what point in life would you go back?

Once you have a breakthrough, you’re getting closer to achieving your goal.

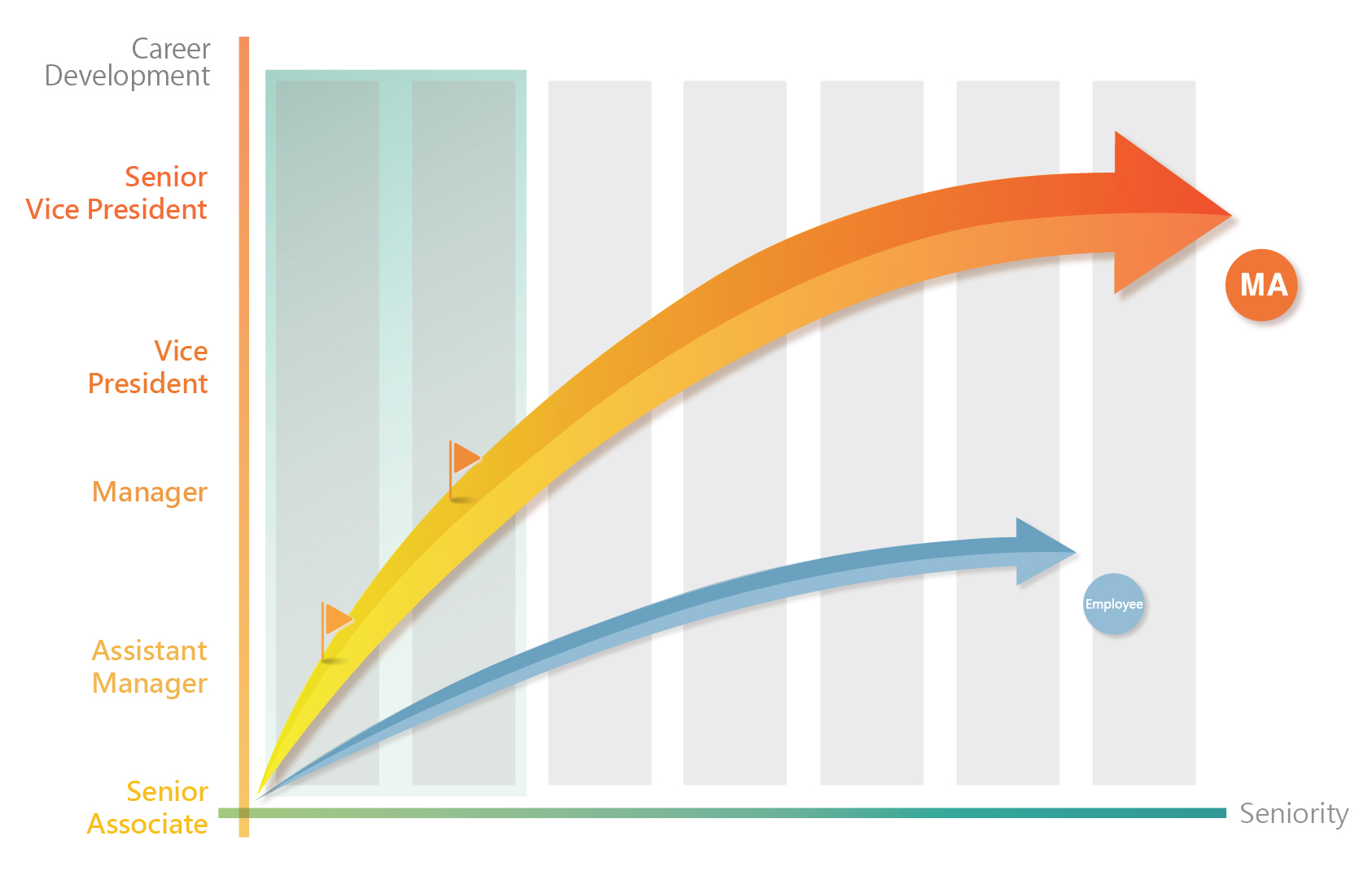

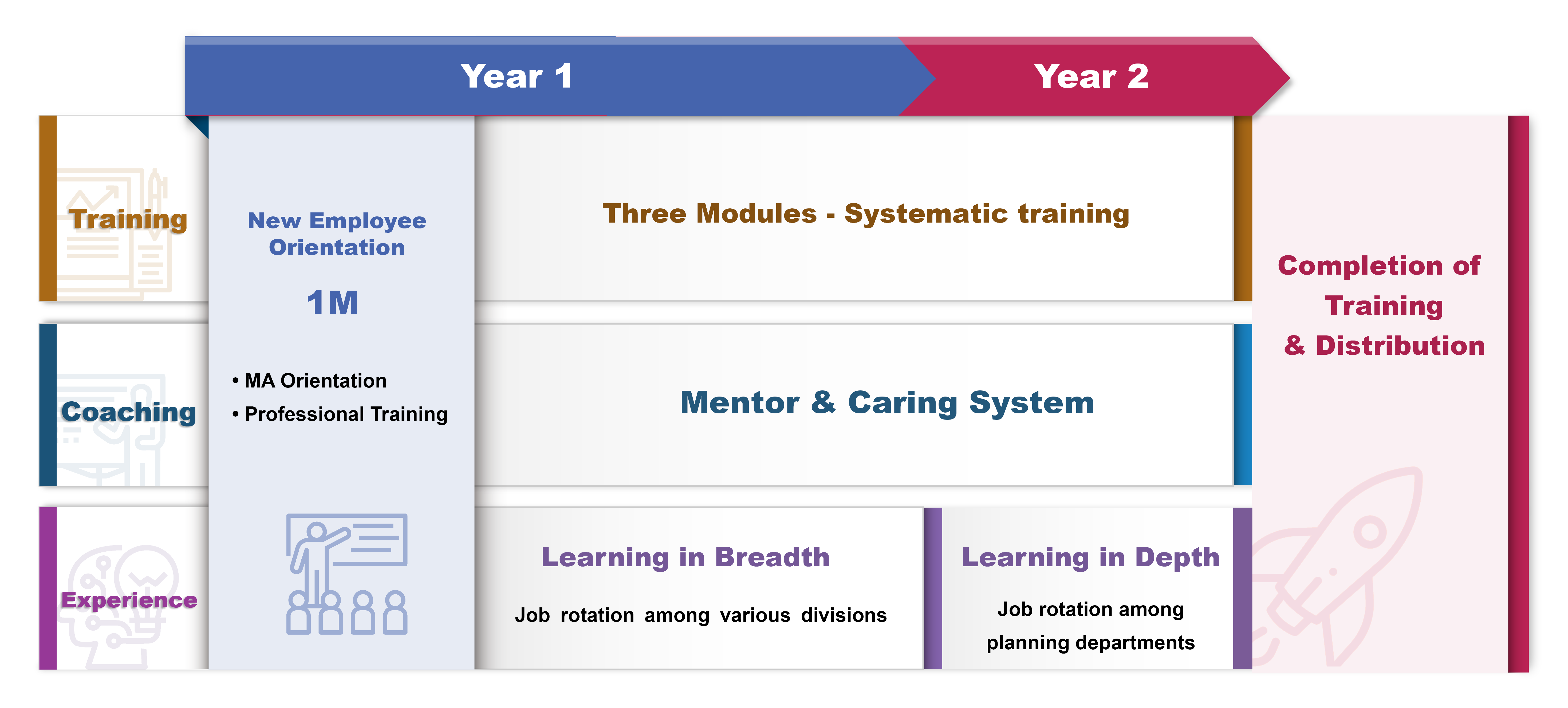

After finishing the first year of training, MA will be promoted to Assistant Manager. In the second year, MA will be further promoted to Manager after completing the entire training program. This provides a fast path for you to rise to junior management, allowing steady career progression in the echelons of talented successors.

We provide MA job rotation across the front, middle, and back offices to expand MAs’ scope of financial knowledge. Your thinking patterns will be boosted strategically through the training and experiencing at strategic planning units, participating in the Company’s major projects, and senior executives’ mentoring.

We provide comprehensive and systematic training courses on finance, operations, and planning, allowing the MAs to keep up with the latest developments and cultivate a mindset of innovation, planning, analysis, and management capabilities.

.jpg)

Aiming to foster international professionals, CTBC has introduced learning resources from world-renown universities, such as the Wharton Business School and Peking University, to broaden our MAs’ scope of global macro views, keep them in line with global financial trends, pave the way for their future participation in international markets, and cultivate their abilities to work across borders.

CTBC MA vacancies spans financial holdings, banks, and insurance systems. Welcome subscribe CTBC Careers Youtube channel to know more about talent recruitment.

MA videosOnly by embracing challenges and aiming to surpass oneself can one conquer new heights

MoreA rigorous and challenging journey

MoreCapturing every chance to grow, challenging myself, and heading toward excellence

MoreTo infinity and Beyond

MoreWant to explore the secrets of the capital market? Join the elite of CTBC Treasury Associates!

MoreTaking on challenges and transforming them into irreplaceable competitive advantage

MoreSeeing More and Seeing Things at a Higher Level

MoreEnjoy learning and challenges, and CTBC will be the best stage for you

MoreConstantly trying to surpass your past self

MoreTaking the trend of insurance transformation head on and insisting on challenging the existing boundaries to be the steerer of insurance finance

More

Please fill in the form directly and submit the original file. (Do not change the setting or save it as a PDF file.)

Indicate “2024MA_your name_Certificate of education” as the title of the file.

Indicate “2024MA_your name_language certificates” as the title of the file.

Participate in any of the following sessions, you will get lucky draw qualification once for NTD$ 10,000 gift. Don't miss the opportunity to communicate with senior MA!

-->| Date | Time | Event |

|---|---|---|

| 2/27(Tue.) | 19:00-20:00 | MA Online Session |

| 3/02(Sat.) | 09:00-17:00 | NTU Campus Job Fair |

| 3/06(Wed.) | 18:30-19:30 | NCCU Session |

| 3/08(Fri.) | 20:00-20:50 | NCKU Session |

| 3/12(Tue.) | 18:00-18:50 | NTHU Session |

Welcome to the CTBC Business Development MA Program, where you will be provided with a unique insight into the strategic minds of the senior management at our CTBC headquarters. Our MA development program offers opportunities to understand all aspects of our financial business, work alongside with the main business operations, exposures to the latest trends of innovations, sharpening your analytical and problem solving skills, and finding the best solutions to realize the visions and objectives of CTBC. During our two-year Business Development MA program, you will experience job rotations through different departments, where you will participate in executive meetings and stimulating projects, to systematically learn the strategic analysis of the principles, the methodologies and the tools of project managements. By cultivating your abilities and skills, CTBC gives you an exciting opportunity to become an independent manager with the expertise in international planning.

Involvement in strategic projects spanning multiple banking areas and business units, assessing potential M&A targets, formulating annual strategies, and serving as the bridge between internal entities (divisions and subsidiaries) and external entities (regulators). Cultivating Business Management MAs to become planning experts and outstanding staffers.

Besides job rotations, the MA program is tasked with project evaluation, training, and assignments, such as courses on planning and logical reasoning, financial analysis, Design Thinking, and communication and presentation skills. The Company invests massive resources into training, giving the MAs ample space to shine.

We value people with a positive mindset, enthusiasm, resilience, learning motivation, a keen sense of observation, and strong logical thinking and analytical skills. Take the Business Development MA Program to learn planning skills and get exposure to the world of international finance. Your journey to take your career to the next level starts here!

As a Financial Management MA, on your path to become an important driver in company operations, you will acquire key financial skills and learn how to plan and analyze financial management decisions, including performance management, fee management, capital management, and financial planning. Carrying out financial analyses will give you an understanding of various dimensions of business performance and allow you to present suggestions for improvement to the company. In addition, the company’s relentless internationalization provides an opportunity for you to become a financial professional with overseas exposure.

Serving as product or channel Financial Controllers, conducting P&L analysis and expense management, assisting the front offices in tracking performance, and participating in projects from budgeting, capital increase, setting up new branches to other tasks assigned by the supervisors.

Involvement in the financial operation of CTBC Holding and the subsidiaries allows the MAs to develop basic financial analysis skills. Participating in inter-departmental projects enables MA to cultivate a strategic mindset. Additionally, the MAs can observe the executives' meetings and receive guidance from the Holding's CFO. Such experiences are advantageous for the MAs in decision-making and developing a strategic mindset.

The cornerstone of business success is a large talent pool. A sound HR management system and a robust talent cultivation scheme hold the key to CTBC's sustained competitive advantage. With CTBC's overseas expansion in recent years, establishing a mechanism for global HR management and promoting talent development in different regions are important tasks of the HR Department.

An incoming MA of the HR team will have the opportunity to learn about all functions of the HR department over two years. By assisting in formulating HR policies in various projects, you will learn to perform organizational design, work force planning, performance management, compensation and benefits calculation as well as employee training and development. By facilitating the making and implementation of work force planning based on the company’s business strategies, you help our strategic business partners accomplish their goals.

The main task of an HR management MA is being the strategic partner for other business units. Being responsible for talent selection, hiring, cultivation, and retention for the business units, HR management MAs are involved in seeking solutions, data analysis, project planning, and scheduling. Additionally, HR is the bridge between internal individuals (talents of each business unit) and external individuals (prospective talents). HR management MAs would receive exclusive training, including basic HR knowledge, courses on planning and logical reasoning, financial analysis, and communication and presentation skills. The MA program cultivates HR expertise and emphasizes planning and proposal capabilities. Additionally, with the opportunity to observe inter-departmental and executive meetings, the program can effectively improve decision-making skills and the strategic mindset of the MAs.

Investment Project MAs are responsible for leading the Group's investment activities and evaluating major investment projects, from insurance, diversified investment, and private equity to real estate. You will be the driver for implementing the Group's investment projects. By joining the MA Program, you will become an excellent financial professional, capable of research and analysis across all industries and management skills.

Within two years, you will receive the most fulfilling training and access top-quality resources. You will learn how to regularly evaluate and strengthen budget management with financial models and improve the Company's profits; you will learn about the risk management mechanisms for investment and the Company's culture concerning risk management. Furthermore, you can analyze investment methodologies and assess investment projects. The multi-faceted rotation design of the Program allows you to cultivate practical know-how of the investment market and gain in-depth knowledge of the current situation and future trends of investment targets. You will independently plan and execute investment positions, give advice on industry allocations, and lead in important investment plans of the Financial Holding Company and CTBC subsidiaries.

Given the uncertainty in the financial market, as the Company is actively heading towards diversified asset allocation, you will keep tabs on the latest investment trends in Taiwan and abroad. The MA Program offers a stage to shine as an outstanding investment professional.

In a diverse, dynamic, and competitive investment environment, Investment Project MAs are responsible for independently compiling analytic reports on investment targets in Taiwan and overseas and have the opportunity to participate in the assessment and decision-making of private equity, discretionary investment, quant trading, and major investment projects. Besides receiving intensive investment analysis and reasoning training, the program enables MAs to quickly accumulate experience and market insights by completing challenging tasks.

Meanwhile, we are committed to providing Investment Project MAs with the best approaches to understanding insurance and venture capital businesses. The MAs can fully expand their asset allocation capabilities through constant learning and keeping up with the latest field developments. Through well-established training schemes, the MAs can cultivate sensitivity and judgment towards the market and agility in responding to various challenges to ensure portfolio performance.

We invite outstanding talents to join us and shine in the financial market! With the complete two-year professional training, you will build a sound foundation on finance and trading and gain in-depth knowledge of the market and future trends. You will rotate across posts at the Bank capital market, Holding Company insurance, and securities to gain a complete understanding of all financial products and business units. Through project assignments and internships, you will quickly pick up the financial market practices and various financial products.

Furthermore, by sharing regularly at morning meetings, you will be able to grasp the latest updates of the global financial market amidst rapid changes and fierce competition. As you trade in the worldwide equity, bonds, and foreign exchange markets, you will experience market volatility first-hand and learn how to assess the market as an independent professional. If you are passionate about trading, resilient to pressure, and willing to take on challenges, join us as Treasury Associates!

The trading desk offers diverse rotation opportunities. The MAs can observe the sales agents close-up, learning how they interact with clients, propose suitable products, and offer accounting advice. The MAs can also learn from traders who encounter a variety of investment instruments. Besides conducting in-house trading, the trading desk also provides the sales agents with competitive prices in the market. The treasury department handles all the funds throughout the bank. The Mas can also learn to trade various investment products and instruments at the Holding Company insurance and securities departments, witnessing robust risk management and control operations at the middle and back offices.

The Investment Business Development MA Program is dedicated to incorporating advanced theories and practices of management science. By constantly improving your judgment and execution discipline, you can adapt to the ever-changing market. Through data-driven analysis of market developments, we establish precise strategic plans for business development, adjust to regulations and changes flexibly, ensure the Company's compliance and sound operation, and provide our investors with the best asset management decisions.

As Market Makers, with constant innovation and disciplined execution, we uphold our mission of vitalizing the securities market and driving the market toward prosperity. You can rotate across the three core underwriting, brokerage, and in-house investment businesses. By working closely with experienced traders and analysts, you will gain a deep understanding of the complexities of investment decision-making and learn to invest with discipline and thorough valuation analysis. You will acquire professional skills and grow in the Company. Meanwhile, we offer comprehensive learning opportunities in investment and trust, ranging from asset management and risk evaluation to trend analysis. With diverse experiences, you will know the ins and outs of portfolio and fund management, gaining extensive skills as an investment professional.

As digital technologies rapidly evolve, we are taking the initiative to introduce big data and digital platforms to the Company's development strategies. By analyzing customer data and financial data with precision and developing flexible and versatile models, you will provide effective and reliable solutions to the Company's business needs. Meanwhile, by creating digital platforms and marketing campaigns, you will contribute to the growth of our customer base, engaging with potential customers and tackling the challenges of the digital age. You will shine at the forefront of fintech and bear witness as the industry leaps forward. Join the Investment Business Development MA Program; you will be an indispensable talent for the Company's future. With continuous training and opportunities to apply such training in practice, we will shape you as a well-rounded professional with extensive knowledge and excellent execution.

In a diverse, dynamic, and competitive investment environment, Investment Business Development MAs are responsible for independently compiling analytic reports on investment targets in Taiwan and overseas and have the opportunity to participate in security investment, fund management, portfolio analysis and optimization, and assessment and decision-making of major investment projects. Besides receiving intensive investment analysis and reasoning training, the program enables MAs to quickly accumulate experience and insights on the financial and securities markets by completing challenging tasks.

Meanwhile, we are committed to providing Investment Business Development MAs with the best approaches to understanding the securities and investment funds businesses. Through constant learning and keeping up with the latest developments in the field, the MAs can fully expand their asset allocation capabilities. Through well-established training schemes, the MAs can cultivate sensitivity and judgment towards the market and agility in responding to various challenges to ensure portfolio performance.

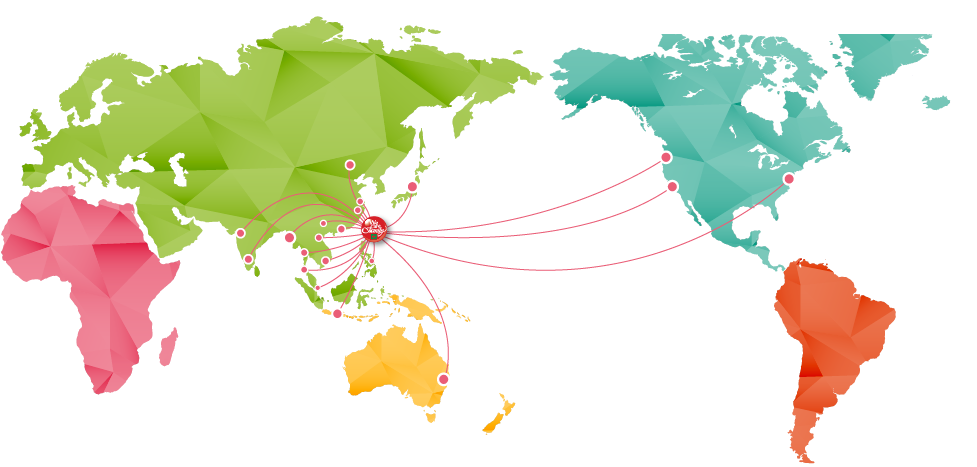

The CTBC Bank Institutional Banking Team provides enterprises with comprehensive custom-made financial solutions, covering areas including business loans, international trade, capital market fund-raising, and financial product transactions. In recent years, the Bank’s institutional banking operations have continued to expand overseas, and with more than 110 branches and subsidiaries across 14 countries and regions in Greater China, Japan, Southeast Asia, and the US, CTBC is the Taiwanese bank with the biggest presence on the international stage. In the future, overseas expansion will continue to be a major focus for CTBC Bank, with the goal of joining the ranks of top-rate international financial institutions.

In this two-year program, institutional Banking MAs receive comprehensive training in professional financial knowledge and skills and test their potential through job rotations in various departments at headquarters, including institutional banking, product planning, and risk management. At the end of the two-year program, MAs have the opportunity to continue to deepen their international exposure and broaden their horizons through an international rotation. The program teaches MAs to think like senior management and rapidly develop into an independent corporate financial consultant or financial product manager.

Institutional banking MAs can explore vast knowledge from the first day of joining CTBC, from systematic professional courses, experience sharing by MA program predecessors, to on-the-job training during job rotations.

By rotating among front offices to administration departments, the MAs can learn about each department's responsibilities and business lines within a short period and internalize the experiences as professional know-how. The tasks include drafting credit reports, attending business meetings, assisting the development and maintenance of RM customers, conducting industry analysis and risk assessment, and familiarizing with the responsibilities of the front, middle, and back offices in institutional banking. Additionally, the MAs learn how to plan institutional banking products, participate in process improvement and global business strategic projects, and enhance planning capabilities and a strategic mindset for businesses overseas.

CTBC Retail Banking Team is engaged in businesses such as digital finance applications, new payment practices, overseas branch operation, premier wealth management and consumer finance. Besides access to personalized courses in finance, Retail Banking MAs will join a 2-year comprehensive job rotation program and interdepartmental projects, which help develop logical thinking and strategic planning abilities while quickly accumulating hands-on experiences with various products and clients. These accumulated financial knowledge and practical experiences will surely equip Retail Banking MAs for being a professional manager after completing this program.

CTBC Retail Banking Team is a trailblazer of wealth management, consumer finance and payment business in Taiwan. By combining smart algorithms and agile development with approaches adopted to identify client needs such as design thinking and big data analytics, we have launched diverse innovative digital financial services such as the “Home Bank” app and conversational ATM. In addition, we have rolled out diverse payment tools in collaboration with industry leaders based on external scenarios. By building industry ecosystems with various sectors, we bring financial services into all parts of daily life to meet the financial needs of our clients and users.

The retail banking team is closely connected to Fintech. The MAs can receive various training and have the opportunity to participate in multiple digital projects using digital deposits, facial recognition, finger vein recognition, and AI speech analystics. Furthermore, the MAs can participate in product ad proposals and cross-industry events. Retail banking MA is optimal for creative and versatile individuals. Besides job rotations, the MA program benefits from Mentorship and periodic discussions with the executives on the business lines and reasoning. The MAs can learn how to draft a substantive and coherent report from start to finish, which would be very helpful in future business execution and proposals.

We invite outstanding talents to join us and shine in the financial market! With the complete two-year professional training, you will build a sound foundation on finance and trading and gain in-depth knowledge of the market and future trends. You will rotate across posts at the Bank capital market, Holding Company insurance, and securities to gain a complete understanding of all financial products and business units. Through project assignments and internships, you will quickly pick up the financial market practices and various financial products.

Furthermore, by sharing regularly at morning meetings, you will be able to grasp the latest updates of the global financial market amidst rapid changes and fierce competition. As you trade in the worldwide equity, bonds, and foreign exchange markets, you will experience market volatility first-hand and learn how to assess the market as an independent professional. If you are passionate about trading, resilient to pressure, and willing to take on challenges, join us as Treasury Associates!

The trading desk offers diverse rotation opportunities. The TAs can observe the sales agents close-up, learning how they interact with clients, propose suitable products, and offer accounting advice. The TAs can also learn from traders who encounter a variety of investment instruments. Besides conducting in-house trading, the trading desk also provides the sales agents with competitive prices in the market. The treasury department handles all the funds throughout the bank. The TAs can also learn to trade various investment products and instruments at the Holding Company insurance and securities departments, witnessing robust risk management and control operations at the middle and back offices.

The Technology team aims to develop digital banking capabilities. With the vision of international operations, the team is responsible for creating an innovative R&D environment, facilitating IT infrastructure modernization, and developing new financial products and innovative services. The Technology team sees customer experience as the utmost priority while bringing new technologies and banking capabilities to life. Joining the Technology MA Program to collaborate with elite from finance, tech, start-ups, and other backgrounds in groundbreaking projects such as cloud technology, artificial intelligence, blockchain, scenario experiments, customer use and authentication, IT infrastructure, cybersecurity governance, and reform. Let's innovate and facilitate change together.

During the first year of training, the MA program allows you to build a sound business knowledge base. In the second year, you can put such knowledge to the test and apply the training to practice. You will deepen your professional skills, broaden your horizons, and excel at planning. While gaining experience from collaborating with domestic and international technology service providers and software and hardware suppliers and participating in leadership meetings, you will quickly cultivate professional know-how and have a comprehensive understanding of the business.

As Fintech advances rapidly worldwide, new banking services have become the core competitive strategy for the banking industry. Technology MAs would have various opportunities to participate in corporate-level digital, IT, and cybersecurity projects, meeting tech specialists across industries, renowned advisors from international firms, and emerging talents. The MAs can grow with the top teams and elites in finance; you would become an interdisciplinary expert in banking and technology.

Other than job rotations, Technology MAs can learn through the following tasks:

Based on a forward-looking global risk management strategy, the risk management team of CTBC has created a risk management culture driven by diverse thinking, specialization and the philosophy of effective integration. We continue to develop advanced risk management programs and make them even more relevant to business development. As the best risk management team in the industry, we are also the best partner to the sales team. CTBC has been recognized by many awards from iconic professional institutions at home and abroad.

The CTBC risk management team is made up of departments specializing in the management of different types of risks, including asset and liability management, institutional credit risk, retail credit risk, market risk, operational risk, country risk and climate risk, as well as integrated risk management. If you are interested in having a career in risk management, joining CTBC will give you an opportunity to receive training in different types of risk management through our rotation program. By participating in the development and implementation of core projects, fintech and assessment technologies used by various risk management units, you will accumulate experience in all areas of risk management and have an opportunity to find out which area is a good fit for you.

Accumulating business know-how: job rotations across all risk management departments and business lines allow the MAs to acquire the knowledge necessary for retail banking, institutional banking, and the capital market. Cultivating planning capabilities: CTBC's risk management department has industry-leading infrastructure closely connected to all business lines. Such an advantage allows the MAs to acquire insights into business applications and risk management through training programs and project implementation. The MAs can develop decision-making skills concerning risk management.

Expanding horizons of the profession: Risk management MAs would participate in various risk planning projects and implement risk management policies. They are involved in inter-departmental communication and collaboration across business lines, companies, and countries.

After Taiwan Life joined CTBC Financial Holding Company, its assets and profits have been growing consistently, making strides towards becoming one of the two key engines of the CTBC Group. Join Taiwan Life's Insurance Business MA Program, and you will learn about an insurance company's critical operations. You will be in step with the latest advancements and innovation trends in the life insurance market and participate in essential transformation projects and strategic plans. You will lead the change in the insurance industry, driving Taiwan Life towards its goals for growth and taking part in the co-marketing campaigns of Taiwan Life and other subsidiaries of the Group so that Taiwan Life and the entire Group can prosper together.

We are committed to cultivating MAs with a comprehensive vision and an independent mindset and excelling at project planning and resource coordination. During the two-year training, you will experience all aspects of an insurance company's operations, from strategic and operational planning to designing insurance service journeys to digital transformation. You will play a meaningful role in executive strategic meetings and critical projects. You will participate in the assessment and execution of major projects, such as the Customer Experience Excellence Program, developing intelligent and digital technologies, ecosystems, and customer relations. From these practices, you will fully understand the Company's operation and learn how to identify, analyze, and solve problems. Meanwhile, by completing various challenges and tasks, you will grow rapidly as a well-rounded insurance professional and a manager.

Insurance Business MAs rotate across Taiwan Life departments, being involved in all aspects of the insurance business operations. The diverse training and hands-on experience allow the MAs to quickly grasp the insurance industry's key points and strategic directions, cultivate a company-level perspective, and develop excellent communication, analysis, and project management skills.

The Company practices rigorous rotation and project evaluation mechanisms while investing vast resources in constructing a systematic training framework. The comprehensive and well-established training program covers courses on professional subjects, operational practices, and personal guidance from mentors and department supervisors. The MAs can shine on the Taiwan Life stage, utilizing the experience gained in the program to become outstanding strategic planning staffers.

I am Hsin-ying He, a Business Development MA 2019 and an NCCU University MBA Program graduate. The advantage of the Business Development MA Program is its flexibility and breadth. With rotation opportunities spanning across various business units and subsidiaries, the Program arranges rotation positions according to the experience and background of each MA and the Group's annual strategic priorities, cultivating each MA to become a planning expert and outstanding staffer. During my training, I rotated to four business units: (1) the Bank's international management department, where I learned how to manage overseas branches across fourteen countries and regions from the CTBC headquarter's perspective; (2) international financial planning & analysis department, where I served as a bridge between CFOs of overseas branches and the headquarter Bank and learned about financial analysis, performance tracking, and budgeting for a bank; (3) the Bank's international retail banking division, where I served a planning position facilitating overseas branches to develop retail banking from a headquarter Bank's perspective and learned to develop strategies according to local market environment, competition, distributional structure, products, and customers; (4) strategic development department of the Financial Holding Company, where I participated in planning for the Group's annual strategies and targets, analysis and evaluation for potential M&A targets, coordination of inter-departmental and inter-subsidiary projects, preparation for Financial Holding Company strategic meetings, and contacting competent authorities.

After completing the MA Program, I continued serving at the strategic development department of the Financial Holding Company, and my three primary responsibilities included:

The CTBC MA Program has a substantial reputation in the financial industry because of the performance of my predecessors and the compact, well-designed, and thorough training program. Unlike ordinary employees, the MA can quickly rotate across multiple positions with higher flexibility and purpose within the two-year training and become a top manager. Furthermore, CTBC is a highly international Taiwanese financial institution, so the MAs work with international colleagues in Taiwan and abroad while training. Upon Program completion, MAs also have abundant expatriate opportunities to broaden their horizons.

However, as the MA Program offers excellent advantages, it comes with pressure and higher expectations. MAs must learn to deal with stress, such as exercise regularly and travel, to loosen up and better prepare for the challenges ahead. Having a better work-life balance will ensure a longer and happier career.

I graduated from the NCCU master's Program in the Department of Money and Banking. During the MA Program, I rotated through the Corporate Banking Group (Taiwan Corporate Banking Division IC5, Taiwan Public & Services Sector Banking Division FI), Commercial Product Division, Capital Market (Structured Finance Division, Funding & Gapping Division), and Finance Management Group (Financial Planning & Analysis Department - Institutional Banking).

Upon completing the training, I was assigned to the Finance Management Group (Financial Planning & Analysis Department - Institutional Banking, Performance Management Department, and International Financial Planning & Analysis Department). My daily work involves financial report analysis, performance management, and formulating resource allocation and other mechanisms. I participated in capital reduction, cost improvement, and efficiency improvement projects, which examined each business unit's capital usage and expenses, gave recommendations, and stipulated relevant policies to improve the utilization of all resources.

Simply put, joining the CTBC family is a rigorous and challenging journey. Along the way, I have questioned myself many times because of the sheer difficulty. I often doubted myself - and to be fair, I may still get caught by self-doubt in the future. As I learned to be a team leader, setting the team's shared goals while respecting team members' individuality from various backgrounds was tough. (I am still learning from the frustration as I write this.) Fortunately, although the journey is rough, I have never been alone, for I have many outstanding fellow journeyers by my side. With their companionship and support, although I may still get lost or stumble sometimes, I still look forward to the next challenge. This remains consistent for my past, current, and future self.

My name is Liu You-Yu. I was an MA back in 2016, and my job now is employee development planning. Unless most of the other MAs from a business background, I graduated from the Department of Psychology of the National Taiwan University before joining the HR Department. During the two years of MA training, I rotated across all functions of the HR Department, serving as an HR business partner at the institutional banking, retail banking, and international units, as well as working at the recruitment, appointment, employee development, and HR management units. The highly intensive job rotation gave me an opportunity to quickly master the most essential HR practices. Besides the daily routines, I was assigned a research project in each of my rotation positions. Having to gather internal and external data within a very short period of time and making proposals based on the data and my analysis, I received solid training that enabled me to grow rapidly and understand key strategic issues relevant to the HR Department.

After graduating from the MA Program, I spent three years at the Strategic Development Department of the Financial Holding, which proved to be a very precious experience. I was tasked with operations management and strategic meeting organization across the subsidiaries of the Financial Holding. By collecting and analyzing issues arising from and pertaining to the business performance and management in various units, I helped the executives track and discuss these issues. Meanwhile, my job also involved assessing potential investment or M&A projects and cross-industry collaboration opportunities. It was a process of gathering and organizing the basic facts of potential partners, analyzing their financial profile, proposing possible transaction structures, and reviewing the financial policies and regulations at home and abroad, which lays the groundwork for further feasibility assessment, transaction structure proposal, investment consideration and synergy evaluation.

Although what I did at the Strategic Development Department was very different from what I had learned at school and what I did as an HR personnel during the MA rotation, the skills I had developed during the training, namely, project planning, problem-solving, communication, as well as the ability to perform under stress, made it possible for me to outdo myself and learn quickly and deliver on every task when put to a different field of expertise.

Because of the proven track records of previous CTBC MA graduates, new MA graduates would receive a training and development plan different from their peers on Day 1 of the job. The two years of training quickly transforms a fresh college graduate into a professional talent capable of working independently. Outstanding graduates from the MA program are very likely assigned vital or challenging tasks, and hence have better opportunities of diverse career development and more favorable salary packages.

Of course, what you give is what you get in return, and highly challenging jobs require more time and endurance. To ensure sustainable stamina at work, I make sure to finish all work during the week, and leave the weekends for leisure activities such as sports and baking. I also have annual personal goals, such as climbing a few of the “100 Peaks of Taiwan” or obtaining Class C Baker Certification, to enjoy a personal life that is also full of diverse activities and challenges. I believe that the time spent in these activities will be food for the soul. Such high-intensity leisure activities require constant practice and thinking, and are thus great for helping me recover from the intense workload and allowing me to stay motivated whenever I feel frustrated!

I am Hsiu-ying Yo, MA of 2019, an NCU Graduate Institute of Finance graduate. I currently work at the C3 construction section, responsible for the Company's largest real estate development project, which plans to build commercial complex properties, including shopping malls, office buildings, churches, and banquet halls. The aim is to generate stable income for the Company while shaping an iconic cityscape for the Taipei East District Gateway Project. In the first year of my MA training, I rotated to the Product Department (II), Performance Management Department, and Risk Management Department. From rotating across the middle and back offices, I learned how to develop investment products, analyze operational data, manage budgets, allocate capital, and manage investment risks. I accumulated capabilities in data analysis, project management, and planning. The experience is also beneficial to the research assignments. In the second year, I started rotating across front offices under the Real Estate Investment Division, serving at posts of real estate investment, project management, development and construction, and real estate management. I gained a systematic understanding of real estate investment. I participated in development evaluation, construction management, and post-investment management, accumulating relevant professional knowledge and establishing a comprehensive investment vision through practice.

Upon completing the MA Program, I was assigned to the Real Estate Division (I), responsible for real estate investment evaluation, which covers project collection, background investigation of investment targets, market analysis, development capacity simulation, product positioning, and financial analysis. My mission is to capture the latest developments in the real estate market, seeking potential targets to generate stable income streams and capital gains for the Company. Within three months of my assignment, I completed the Company's first urban development equity investment project, with me being solely in charge of the project's management and contract fulfillment.

My daily tasks include tracking project developments and relaying CTBC feedback to counterparties, which require proficiency in real estate and communication skills. Later, I transferred to the C3 construction section, managing the C3 development project. My role is to help the project team monitor the construction status, regularly updating board members and executives on the project. Real estate investment is a new area for me. Still, with the foundation I built during the MA rotation and the hands-on experience in real estate development, I can take on these challenges independently as an investment professional, applying experience to my daily work. I treasure every opportunity to participate in any project, striving to surpass myself and advance further.

The MA training is compact and intense; with one challenge after another, I accumulate various capabilities and advance through the ranks quickly. I find the MA Program has three advantages in advancing my career. Firstly, attending major corporate meetings allows me to understand the Company's strategic plans and the executives' decision-making process. Secondly, diverse rotation opportunities will enable me to expand my vision and build a personal network that will benefit inter-departmental communication in the future. Thirdly, being mentored by high-level executives makes the MAs stand out compared to other colleagues, opening up more opportunities to participate in critical projects and essential missions.

I am Yi-chen Wu, TA of 2022, who graduated from the NCCU master's Program in the Department of Money and Banking. After nine months of rotation, I work at the Funding & Gapping Division - the long-term bond investment section. During my TA training, I got to learn about the ins and outs of the trading desk, from the front offices (Trading Division, Treasury Sales Division, and Funding & Gapping Division), middle offices (Financial Markets Risk Division) to the back offices (Treasury OP & IT Division). I grasped each division's core functions and discovered my passion and interests.

During my rotation, besides accumulating professional knowledge, I also became equipped with independent thinking while I helped solve business pain points and optimize operational processes. I got the opportunity to shine at the trading desk. Through research assignments, I explored strategies and new products beneficial to the trading desk, developing problem-solving capabilities, logical analysis, and strategic planning. Want to explore the secrets of the market? Join the TA Program! This is a training ground for financial knowledge and practice and a stage to discover your potential and shine. Starting your career at CTBC is your best choice!

The long-term bond investment section is responsible for the Bank's credit debt investment, which requires professional knowledge and sensitivity to capture opportunities in the ever-changing market. Furthermore, it requires proficiency in financial report analysis to evaluate the debtors' financial conditions and future solvency. My daily tasks involve tracking the latest market movements; I also have the opportunity to communicate with world-renowned traders and economists, learn from their insights on the capital market, and strengthen my professional skills and knowledge.

For my two research reports, I studied and analyzed the impact of the new insurance accounting standard on life insurance companies and a bank's trading desk. Such significant changes require the insurance industry to re-evaluate its business models and operational strategies. Changes to hedging behavior would also affect the performance of a bank's trading desk. In addition, as the world encounters the wave of ESG, I researched the SBTi temperature rating and its impact on the Banking Book Portfolio upon implementation. As the Financial Holding Company proposes emission reduction targets, the trading offices must consider ESG factors when selecting investment targets and gradually reduce their position in high-emission industries. This is consistent with the global trend towards sustainability and better fulfills the portfolio's social responsibility, strengthening the Company's stance on responsible investing.

Despite all the obstacles during training, I never ceased to challenge myself, and I saw tangible growth in my professional capabilities and mindset. After going through multiple cycles of being under pressure, adjusting, and adapting, I learned to be resilient and confident in facing a challenge, enabling me to take hardships in stride.

Apart from the comprehensive training, the Program also offers extensive resources: software services like Bloomberg and Reuters are readily available, allowing me to monitor global financial market developments up close. During rotation, I also got the rare opportunity to work alongside the best traders and sales in Taiwan, learning from them and receiving guidance from high-level executives. After rotation, you are bound to be a capable, independent professional. Besides, the Program offers the industry the fastest track to career advancement (two promotions in two years). If you are interested and passionate about trading and are willing to take on challenges, join CTBC! Let's go above and beyond together!

I am Yu-chi Tzeng, Institutional Banking MA of 2017. I graduated from the NTU Graduate School of Finance and am currently working in the planning section of the Institutional Banking Credit Analysis Division. I started the two-year rotation journey shortly after joining the industry; I spent the first eight months at the front desk, receiving full training on credit analysis, and rotated across middle and back offices every three months. I learned how to analyze business numbers from a manager's perspective, assess the impact of idiosyncratic events on the business, and make annual budgets in the business management department. At the risk offices, through the one-on-one mentorship, I observed senior supervisors close up as they identified credit risks and advised on credit extensions. The operations department is where I quickly grasped the vast structure of the back offices; the product department is where I gained hands-on experience developing innovative products; and the staffer department is where I participated in major institutional banking projects and accumulated analysis and planning capabilities. In particular, I could attend the China Banking Regulatory Commission's Beijing Belt and Road Initiative closed-door meeting on behalf of CTBC - it was such a rare opportunity for me. Every stop along the rotation journey marks the unique growth experience and capabilities gained for each MA.

Upon completing the MA Program, I was assigned to a sales department as an assistant relationship manager (ARM), dealing with customers at the front line. My responsibilities include understanding customer needs, exploring business opportunities, service delivery, and trading. During this time, I have accumulated extensive KYC and sales capabilities. I have also polished my communication and problem-solving skills. The two-and-a-half years of practical experience have nurtured and prepared me for the journey ahead.

Later, I joined the planning realm, serving in the credit department and participating in major division-wide projects and strategic reports. Notably, while working on the cross-border collaboration optimization projects for credit, I participated in the whole process, from interviews, identifying pain points and their root causes, solution evaluation, and planning to execution. Drawing from the extensive lessons and people network built during the MA rotation, I could focus on critical issues quickly. The fulfilling ARM experience helped me during project execution, and I came up with optimal solutions suitable for customer-facing colleagues. Looking back at my journey, the extensive knowledge I acquired in training and the hands-on experience I gained from the various assignments allow me to keep an open mind when encountering new challenges. With time, the challenges I tackled were transformed into irreplaceable competitive advantages, making me more forward-looking, agile, and innovative. CTBC is always there, helping us grow towards our goals.

The extensive learning and network-building during training enabled me to build professional skills and my unique competitive advantages quickly. The training I received has become the driving force as I was assigned to various posts, facing different tasks and challenges. The mentorship offers the opportunity to communicate directly with senior supervisors. Besides advising on my projects and offering resources, the mentors' experience sharing is precious for a newcomer to the trade. The two-year training is so compact that the journey was never easy. However, whatever effort I put in has become a direct investment in myself, fundamentally impacting my career. I encourage us all to fully utilize the experience and skills we accumulate along the way to work smart and achieve a work-life balance.

I am Su Kuan-Wei from the Retail Banking MA Program in 2020. Having graduated from the Department of International Business of the National Taiwan University, I currently serve at the Private Wealth Segment Department of the Private Wealth Management Division.

During the MA Program, I rotated between various business units of retail banking: the front office (front desk services), the middle and back offices (business management), strategic planning, products, digital platforms, and overseas retail banking. In addition to the diverse range of businesses I handled in these units, I was also tasked with other assignments such as project research, strategic planning, market dynamics analysis, and customer experience survey. The CTBC MA Program provides solid training and a learning experience of breadth, depth, and vision.

I was assigned to the Private Wealth Management Division straight out of the Program. My job involves a wide range of duties, such as researching and summarizing the market trends in private banking, analyzing and producing insights of high-net-worth customers, and executing marketing campaigns. My responsibility in the ongoing High-Net-Worth Project is to conduct qualitative and quantitative research to develop an in-depth and comprehensive understanding of the needs of high-net-worth and ultra-high-net-worth customers, create medium- and long-term business and strategic plans, and develop premium services for these customers. Through the two-year MA rotation and training as well as my work experience ever since, I have grown in the following three areas:

First, strategic thinking: Training on department-specific topics and strategic planning does not just help MAs quickly learn to summarize problems and master key problem-solving skills, but also enables us to develop planning, decision-making, financial analysis abilities.

Second, communication skills: As many projects rely on cross-departmental communication and collaboration, MAs develop better coordination skills and presentation skills, which helps us perform better on stage and are thus more likely to be seen.

Third, professionalism: Although rotating between the front, middle and back offices was very busy, it allowed me to have an overview of retail banking. The experience of working in multiple departments also enables MAs to see more and see things from a higher level. We grow with the company, which is the perfect embodiment of “Go Beyond”.

MA rotation gives us access to a different set of opportunities inaccessible to others. Going through various tests and rotations, we are on a fast track of capability development and ultimately a fast track to promotion. The company has also invested a lot of resources in MA training. In addition to the job training across various units, we also receive guidance from senior executives on a regular basis, so that we can see things from the perspectives and levels of the management. This is a highly efficient way of helping us become professional managers.

Despite being very busy during the rotation period, I picked up new hobbies in my spare time once I got more familiar with the job. Hiking, diving, and exercising weekly has helped me release stress and sharpen my mind, giving me better quality of life.

I am Yun-yu, Technology (IT) MA of 2021. Unlike common assumptions, I graduated from the NCCU Department of Public Finance with no STEM background. During the two-year MA training, I rotated across all functions under the Technology Group, including the Technology Planning Department, Cybersecurity Management Department, Digital Finance Division, and Data Intelligence R&D Division. After completing the MA Program, I served in the Technology Planning Department. The high-pressure, fast-paced rotation enables me to quickly grasp the latest technology development trends and applications of the Bank by completing research assignments and routine projects assigned by business unit supervisors. The research assignments helped me cultivate capabilities of collecting and analyzing internal and external information within a short time and proposing adequate solutions for the Bank. While participating in the routine projects, supervisors encouraged the MAs to be active in discussions, and I learned how to digest information and promptly elaborate on my thought process. Besides extensive professional training, supervisors also generously taught us presentation skills, guiding us to formulate presentation strategies according to the target audience to deliver information more effectively. The two-year rotation offers training on my professional capabilities and soft skills, elevating my technical skillset and strategic planning so that I can grow and find my stage to shine.

After completing the MA Program, I was assigned to the Technology Planning Department, where my responsibilities involved strategic planning on the Bank's IT resource utilization. I gather and analyze information on leading international banks regarding financial performance, talent retainment, and project execution referring to external KPIs and compare them against CTBC indicators, such as information governance. My work serves as a reference for high-level executives in tracking CTBC performance and bringing discussions into focus. Meanwhile, I also research the latest trends in external technologies to identify potential application opportunities and evaluate and formulate the Bank's long-term IT strategic development.

Reflecting upon the two-year rotation and the practical experience afterward, I advanced in three significant capabilities. First, I gained in strategic thinking. Research assignments, hands-on experience, and courses arranged by HR on subjects from project planning and logical reasoning to financial analysis equip the MAs with the capabilities to identify, clarify, and resolve problems. Second, I can learn more quickly; the fast-paced rotation program ensures that the MAs learn how to comb through and prioritize critical issues within a short time. Thirdly, I cultivated interdisciplinary professional know-how by rotating across multiple departments. I get to familiarize myself with the domain know-how of each business unit and broaden my horizons. Within the highly competitive MA program, I'm constantly challenged to Go Beyond and surpass myself, which is the key to cultivating all professional capabilities.

CTBC offers such compact and comprehensive training and helps the MAs accumulate capabilities via job rotation, enhancing the MAs' breadth and depth in professional skills. During rotation, I gained proficient knowledge of each department and built a personal network at CTBC, which is the foundation of my future career development. The MAs also have the opportunity to receive guidance from high-level supervisors, learning to analyze the whole picture. The supervisors' insights from experience are also instrumental in broadening my vision and improving my capabilities. CTBC offers a stage where one can shine and advance quickly. If you enjoy challenges, the CTBC MA Program is your best choice!

I am Ting-yu Kuo, Risk Management MA of 2022. I graduated from the NTU Graduate School of Finance, and my current rotation post is in the Market Risk Management Department of the Financial Markets Risk Division. During the MA Program, I rotated across retail banking risk management, retail banking products, institutional banking risk management, Institutional Banking Credit Analysis Division, and market risk management, gaining experience throughout the three central business units' risk management and sales departments. Training during rotation includes case studies, practices and operations, and meeting participation. With compact and professional training, I learned how the sales and risk management departments collaborate and gained a complete understanding of risk-related decision-making for each business unit.

Reflecting on the past one-and-half years of the MA Program, the project that allowed me to grow and gain the most sense of achievement is the research project on risk management strategies for overseas business. The project explores potential business opportunities from current operations, drawing from the successful experience in Taiwan, integrating overseas business risk management practices, and planning for a local-driven risk management mechanism. This project allows me to build on the foundation of my MA training and be creative in discovering new opportunities overseas for CTBC. The Program is not always smooth sailing; I always encourage myself to remain courageous whenever I encounter challenges or frustrations. Believing I'm heading towards a vantage point where I can see further and broader, I’m constantly trying to surpass my past self!

One of the most significant advantages of being an MA is the direct mentorship from high-level supervisors, where we can learn from their mindset and decision-making. By rotating to different business units, the MA can understand the Bank's operations comprehensively and enjoy executive-level managers' birdseye view and insights. In this journey, I trained myself to be more thorough and better understand the Bank's operations. Furthermore, even with a hectic and compact training schedule, I maintain a work-life balance, spending time with family and friends and cultivating my interests because it benefits my efficiency and flexibility at work.

I am Wei-ting, CTBC MA of 2018, MSc international business management, University of Southampton. I currently serve at the Taiwan Life Operations & Planning Division. During the two-year rotation, I rotated through six business units across the Bank, the Financial Holding Company, and Taiwan Life. The thorough training program cultivated my resilience and professional mindset, allowing me to analyze and resolve problems quickly.

After completing the MA Program, I was assigned to the Operation & Planning Division, where I first participated in deploying digital infrastructure for customer-facing operations. I served as project PM of LINE tool development, in which capacity I learned how to develop multiple complex functions simultaneously. I also learned how to manage tasks effectively, keeping up with determined schedules. Since the projects I was involved in numerous business units and external vendors, I learned the importance of inter-departmental communication and understanding the know-how of each function. I had to visit each business unit to understand their procedures and operational needs and communicate such information with internal IT departments and external vendors to develop an official LINE account that is the hub of all insurance functions and is easy for the customers to use.

Regarding distribution operations, since I currently serve as the project manager for a significant project - expanding the scale of sales agents at the Financial Holding Company, my responsibilities include coordination, communication, and planning the sales channels. Besides clarifying the sales process of agents, conducting multi-faceted analyses, and planning the targets, business model, and schedule of the project, I also need to think ahead, picturing the mid to long-term obstacles to the sales agents and growth, benchmarking market competition, and analyzing the strengths and weaknesses, before determining how to executive the ultimate project. The project manager serves as the "brain" of distribution operations; I need to adapt to changes in agent strategies. I must formulate structures and adjust the directions promptly and rapidly to ensure effective operations accommodating market needs. Furthermore, I find it challenging to communicate the content of the projects and execute them across various companies, divisions, departments, sections, and supervisors.

After the MA Program, I participated in significant transformation projects at Taiwan Life. Fortunately, the skills I acquired in the MA Program, from resilience, problem-solving, and analysis to communication, are all helpful in these projects, and I see tangible results.

The MA Program has many career advantages. Among them, two are incredibly unique compared to the journey of other colleagues: Firstly, the personal network and experience built from the rotation across multiple business units will serve as nutrients in my future career, making inter-departmental communication and collaboration much more effortless. Secondly, the MAs can be mentored by high-level supervisors, making them more visible and more likely to be assigned to important projects. In my personal experience, I was given the role of project manager for a major project right after the training period, reporting to executives directly. Learning from officer-level executives and witnessing their decision-making helped elevate my insights and reasoning. Although major assignments come with pressure and challenges, they also bring a stronger sense of achievement. The experience I gained in the process is also immeasurable - this is not available to other colleagues. At work, I am always committed, whereas, in life, I still have my personal time and family life - this is because once you have taken on more responsibilities, you will be more adaptive and able to achieve a work-life balance.

We sincerely invite you to join CTBC family.

You and CTBC will become the leading Chinese Financial Institution.